| ASIA UNITED BANK | BANK OF COMMERCE | BANCO DE ORO | BPI | CHINABANK | CITIBANK | EWB | EQB | HOME CREDIT | HSBC | LBP | MPI | METROBANK | PNB ABC |

RCBC BANKARD | ROBINSONS BANK | SECURITY BANK | UNION BANK | |

| Revolving Interest Rate /Financial Charge |

2.00% monthly interest rate (across all card types) |

2% | 2% MEIR | 2.00% / (1.82%) | 2% (across all card types) | 2.00% | Highest: 2% per month or 24% effective rate annually Lowest: 1.99% per month or 23.88% effective rate annually |

2.0% - Dollar 2.0% - Peso |

2% per month | 2% per month | 2% per month | 2% | 2.00% | 1.88% to 2% for Peso and 2% for Dollar | 2% | 2% | 2.00% | 2.00% per month |

| Late Payment Charges | PHP 750 or the unpaid minimum amount due, whichever is lower shall be charged for every billing that the account is past due (PHP 750 for Monthly Payment Option; PHP 375 for Semi-monthly Payment Option; PHP187.50 for Weekly Payment Option) |

Php1000 ( PESO BILLING ); USD20 (DOLLAR BILLING) or the unpaid minimum amount due whichever is lower |

7.00% of the overdue amount | P850 or equivalent to the value of the unpaid minimum amount due, whichever is lower, will be charged per occurrence per card. |

Php750 or the unpaid minimum amount due, whichever is lower | Php 1,500 or the unpaid Minimum Amount Due, whichever is lower | 8% of the Minimum Payment Due Effective June 18, 2021: Php1,500 or the unpaid Minimum Payment Due, whichever is lower |

4.0% - Dollar 6.0% - Peso |

PHP 500 or equivalent to the value of the unpaid minimum amount due,whichever is lower | Php1,000 or unpaid minimum amount due, whichever is lower |

2.25% based on unpaid Minimum Amount Due (MAD) | P700 or unpaid minimum due, whichever is lower. | PHP850 / USD16 or UMAD whichever is lower |

7% (Peso) and 5% (Dollar) of the unsettled minimum amount due | Php850 or the minimum amount due, whichever is lower. | P750 | Existing: Php600 or 6% of min. amt due whichever is lower |

Php750 |

| Over-limit Fee | N/A | Php500 (PESO BILLING); USD10 (DOLLAR BILLING) |

none | N/A | Php500 | Php 1,500 or the highest overlimit amount during the billing period, whichever is lower | Highest: Php700 Lowest: Php500 |

N/A | N/A | Php800 if the outstanding balance exceeds the credit limit at any time within the statement period. This will only be carged once within the statement period. | n/a | Php750 | PHP750 / USD15 per occurrence | Php 300 or US $10 | Php600 to be charged at any time when the outstanding balance plus unbilled installment exceeds the permanent credit limit. The Over Limit Fee will be charged once within the statement cycle. |

P750 | Php500 per occurrence | Php500 |

| Card Replacement Fee | P500 per card replaced | Php200 - Php300 | P400 for each card | PHP 400 / card | Highest: PHP700 Lowest: PHP500 |

Php 400 for each lost or stolen Card | Highest: Php500 Lowest: Php400 |

P400 per card | PHP 250 | Php400 | Php300.00 | P400 for each card | PHP400 / USD10 | Php 400 | Php300 - Php500 | P750 | 400 | Php400 |

| Foreign Exchange Conversion Fee | Transactions made in foreign currencies shall be automatically converted to PHP using Mastercard's selected foreign exchange rate. From the Peso conversion, AUB will add Mastercard's Issuer Cross Border and Currency Conversion Assessment Fees. A 1.5% service fee shall be charged by AUB and shall be added to the sum of the Peso Conversion & Mastercard Fees | 2.5% (consists of Mastercard's assessment fee and BankCom service fee) |

1% Cross Border Fee (except 0.80% for retail transactions and 0.10%for cash advance for UnionPay) and 1.5% Foreign Exchange Conversion Fee for Mastercard/VISA/JCB/Diners. For American Express, a conversion factor of 2.5% will be applied, of which, 1% is retained by American Express. |

1.85% | 2.50% | Up to 3.525% of the converted amount | Highest: 2.5% Lowest: 1.7% |

Transactions made in foreign currencies other than USD will be converted to USD based on the brand/ association's foreign exchange rate. It may differ from the rates in effect on the transaction date, increased by processing/service fee of 2%. Same fees shall also apply to transactions which the Carholder has opted at point-of-sale to be billed in the Philippine Peso or online transactions executed at merchant local currency but processed outside the Philippines. | 2.50% of the transaction amount | 2.5% of the converted sum plus reimbursement of the assessment fee charged by Visa/MasterCard to HSBC equivalent to 1% of the converted sum |

Based on prevailing Mastercard Foreign Currency Conversion Rate plus 2% Assessment and Service Fee |

Platinum: 0.75% of the converted amount using the foreign exchange rate of Mastercard/Visa, plus the 1% assessment fee of Visa/Mastercard Gold:1% of the converted amount using the foreign exchange rate of Mastercard/Visa, plus the 1% assessment fee of Visa/Mastercard Classic/Standard: 1.50% of the converted amount using the foreign exchange rate of Mastercard/Visa, plus the 1% assessment fee of Visa/Mastercard |

Foreign exchange will be based on MBTC's FOREX selling rate at the time the transaction is posted. Fee includes 2.5% processing fee plus 1% assessment fee charged by Mastercard/Visa. | 2.5% of the converted amount using Mastercard/ Visa/UnionPay’s conversion rate of the day | 3.50% representing the Mastercard/Visa/JCB/UnionPay assessment fees and the Bank's service fee. For foreign currency transactions converted to Philippine Peso at point of sale, whether executed in the Philippines, abroad or online, a service fee of 2.25% shall be applied to transactions amounting to Php1,000 and up, or its foreign currency equivalent. | 3% | 1% Mastercard Assessment Fee and 1.5% service fee |

2% to 3% |

| Annual Membership Fee | Waived for life | Php1,500- Php6,000 | P1,000 – P5,000 (USD65 – USD1,500) or P125 - P250 / month |

PHP 1,300 to PHP 5,500 | Highest: PHP25,000 Lowest: PHP1,500 |

AMF ranges from: Php 1,500 to Php 12,000 for principal cards Php 750 to Php 6,000 for Supplementary cards |

a) Principal cards: Highest: Php5,000 Lowest: Php1,200 to perpetually waived b) Supplementary cards: Highest: Php2,500 Lowest: Php600 to perpetually waived |

P1,000 - Classic Credit Card P2,000- Gold Credit Card |

75 PHP monthly | PHP1,200 - PHP5,000 | Waived for the First Year For Gold Card Principal-2,500.00/Supplementary-1,000.00 For Classic Card Principal-1,000.00/Supplementary-250.00 |

Classic/Standard: Primary 2,000; Supplementary P1,000 Gold: Primary 2,500; Supplementary P1,500 Platinum: Primary 3,500; Supplementary P1,750 Visa Infinite: Primary P5,000; Supplementary P2,500 |

Depends on Card Type Highest PHP6,000 - Lowest PHP800 to perpetually waived |

Highest: PHP6,000 Lowest: none |

Php1,000 - Php5,000 | Range Annual: P2,500- P3,000 Monthly: P100/month |

Php2,000 to Php5,000 (range) | Principal: Php1,500 to Php5,000 Supplementary: Php750 to Php2,500 |

| Joining Fee | N/A | n/a | none | N/A | N/A | Not Applicable | NA | N/A | N/A | N/A | n/a | n/a | N/A | none | n/a | n/a | None | N/A |

| Cash Advance Fee | N/A | Php200 per transaction (Peso Billing) or USD4 per transaction (Dollar Billing) plus prevailing finance charge |

P200/USD4 per transaction | PHP200 | N/A | Php 200 per Citi Cash Advance transaction | Php200 per cash advance availment | USD4.00 per transaction regardless of amount - Dollar P200.00 per transaction regardless of amount - Peso |

PHP200 for every transaction | PHP200 for every transaction | 5% of amount withdrawn but not exceed P200 | P200 per transaction | PHP200 / USD4 per transaction regardless of the cash advance amount | PHP 200 for Peso US $4 for Dollar |

Php200 | n/a | P200 | P200 Flat Service Fee will be charged per cash advance transaction |

| Balance Transfer Fee | 1.00% monthly add-on interest for 6 and 12 months | n/a | none | Service Fee PHP 100 Depending on Variant and Term 0.75% - 1.00% Add-on Interest Rate |

N/A | Php 900 for each approved Citi Balance Transfer transaction |

PHP250 in April and May (promotional for select cardholders) Effective June 24, 2021: A fixed processing fee will be applied for every approved Insta-Cash, Balance Transfer and Convert-to-Installment transactions. Php250 via electronic channels (ESTA or EastWest System Tech Assistant chatbot, EastWest Online and EastWest Mobile App) or Php500 via our Customer Service hotline. |

N/A | N/A | PHP650 per approved Balance Transfer transaction | n/a | n/a | P250 per approved Balance Transfer transaction |

|

Php250 | As low as P80.10 and varies depending on the requested amount and installment term. | Service Fee: None Add-on Rate: 1.00% AOR *Special rates may be offered to select cardholders |

N/A |

| Charge Slip Retrieval Fee | PHP 250 for each local sales slip and PHP 500 for each international sales slip retrieved upon request, for whatever reason. The same amount will be charged to the cardholder for each sales slip retrieved by the bank arising from an invalid dispute. | Php300 for local and USD6 for international purchases | P300 for each local transaction sales slip retrieved or P500 for international transaction | PHP 300 / charge slip | PHP500 (for local) or USD20 (for international) per charge slip | P250 per charge slip | Php200 for the retrieval of each retail/installment and mail-order/telephone-order charge slip; Php1,250 for the retrieval of each travel and entertainment charge slip |

P350 per sales slip (local and international) P1,200 per slip for travel and entertainment merchant |

N/A | PHP275 | Php350.00 | Php300.00 per sales slip retrieved for local transactions and Php500 per sales slip for international transactions upon request of the cardholder for whatever reason. The same amount will be charged to the cardholder for each sales slip retrieved by the bank arising from an invalid dispute | N/A | Php 400 or US $15 (per Sales Slip) | Php150 | P500 | Php400 per sales slip | Php200 per transaction slip |

| Return Check Fee | PHP 1,000 for every check deposited as credit card payment which is subsequently returned | Php1,000 | P1,250 / USD35 for each returned check/insufficient ADA account | P100 for every returned check and additional 6% of the check amount |

PHP1,000 | Php 1,500 per returned check | Php1,500 | P1,000 - regular check payment P500 plus applicable PCHC Fees - Super Check |

N/A | PHP1,000 | Php500.00 | Php1,250.00 for each returned check on top of the standard bank charges on returned checks | PHP1,500 | Php 1,000 for Peso account or US $10 for Dollar account | Php1,000 | P1000 | P1,250 for Peso per returned check USD25 for Dollar per returned check |

Php1,500/returned check |

| Billing Statement Reprint | N/A | Php100 | P30 / USD1 per SOA request | PHP 200 / Copy of Statement of Account | PHP100 per SOA | Not Applicable | Effective June 18, 2021: Php200 for every copy of credit card Statement of Account | P100 per statement of account | N/A | N/A | Php100.00 | Php300 per request | PHP100 per request for reprinting and delivery of monthly statement. Not applicable to Dollar MC, World MC, Peso Platinum MC, Femme Signature Visa, and Travel Platinum Visa | Php 50 per statement | WAIVED | P500 | P50 per page if requested billings statement is more than 3 months old | Php300/statement |

| Cash Advance Over-the-Counter Fee |

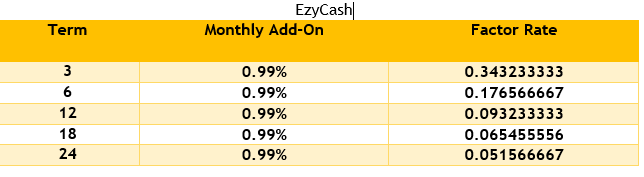

N/A | Php100 | NA | N/A | Not Applicable | NA | N/A | N/A | N/A | n/a | P100 plus actual bank charges for deposit of EzyCash manager's check to cardholders depository bank, if any. | N/A | none | n/a | n/a | P200 | N/A | |

| Gambling and Gaming Fee | N/A | 5% of the transaction amount | 5% of transacted amount or P500 / $10, whichever is higher |

P500 or 3% of the gaming transaction, whichever is higher, shall be charged for every gaming transaction in casinos and/or online betting | N/A | Not Applicable | 5% service fee shall be charged on gaming/gambling transactions and/or transactions made at gaming/gambling establishments | N/A | N/A | N/A | n/a | 5% of the amount transacted | none | 5% of every transaction or P1,000, whichever is higher. | 5% of the transaction amount | Under Quasi-cash Fee - 2.50% of transacted amount (effective January 25, 2021) |

5% service fee | |

| Multiple Payment Fee | N/A | Php50 (PESO BILLING) USD1 (DOLLAR BILLING) |

NA | PHP50 for every payment made through payment channels other than CBC, starting from the 4th payment onwards per statement cycle |

Not Applicable | Php50 fee will be charged for each payment posted after the third payment transaction. | N/A | N/A | N/A | n/a | n/a | N/A | Php 40 per payment in excess of 3 for all approved payment channels (PNB and non-PNB). | Php40 for every payment in excess of 3 payments within a statement cycle in non-RCBC payment channels: Bancnet, BDO, BPI, CIS Bayad Center, SM Payment Center, Unionbank |

P40 | PHP 50 or USD 1 will be charged for every payment in excess of 2 payments within a billing cycle | N/A | |

| Installment Pre-Termination Processing Fee | PHP 500 or 5% of the unpaid principal amount, whichever is higher, for every In-house Installment Plan transaction pre-terminated |

Php1,000 | P550 plus 2% of the loan principal amount if pre-terminated before the first billing. P550 plus applicable interest of the next monthly payment if pre-terminated after the first billing using the diminishing balance method. |

5% of the remaining unpaid installment balance or PHP500, whichever is higher |

Php 300 applicable to Citi PayLite, Citi PayLite after purchase, and Citi PayLite for bank transactions. 4% of unbilled portion of the Principal Amount, applicable to Citi FlexiBill, Citi Balance Transfer and Citi Speed Cash. |

5% of the remaining principal balance or Php500, whichever is higher |

5.0% of the unpaid principal amount or P500.00,whichever is higher |

N/A | - Php500 for merchant installment - 5% of the remaining principal balance or Php300, whichever is higher, for Balance Transfer, Cash Installment Plan and Balance Conversion Plan |

5% of remaining balance or P300 whichever is higher | 5% of the remaining principal balance or P500 whichever is higher. | 5% of the remaining principal balance or P550 whichever is higher | 5% based on the remaining unpaid installment or Php 500, whichever is higher | 5% of the unpaid amount or Php500, whichever is higher plus one month's worth of interest, as computed based on the unpaid balance | 5% of the remaining principal | 5% of Unbilled portion of the principal amount | 5% of the remaining principal balance or P500 whichever is higher | |

| Closed Card Account Service Fee | N/A | Php200 | P200/month or the overpayment amount if less than P200, will be debited from: A) Closed credit card accounts with overpayment for more than one (1) month from the date of termination/cancellation B) Credit card accounts with overpayment with no activity for the past 12 months |

PHP200 or the amount equivalent to the credit balance, whichever is lower. | Not Applicable | Php200 | N/A | N/A | n/a | In case of cancellation of account and an overpayment is unclaimed for more than 1 month from the date of cancellation, a monthly fee of P200 will be charged on the account until balance is zeroed out. |

PHP200 / USD4 or an amount equivalent to the credit balance, whichever is lower, will be charged monthly to accounts with overpayments that are closed or active accounts that have no activity for the past 12 months until the credit balance is zeroed out. |

Php 200 for Peso acount & US $5 for Dollar account or the equivalent to the credit balance, whichever is lower | n/a | P50 | None | N/A | ||

| Refund Fee | Php500 | 1% of the amount to be refunded or P100 / $2.50, whichever is higher |

PHP300 | Not Applicable | 1% of the refund amount or PHP100 / USD2, whichever is higher, for every refund request |

P500 | ||||||||||||

| Bank Certification Fee | PHP300 | Not Applicable | PPHP100 per copy and delivery of the bank certificate. Not applicable to Dollar MC, World MC, Peso Platinum MC, Femme Signature Visa, and Travel Platinum Visa |

P100 | ||||||||||||||

| Overseas Card Delivery Fee | P2,500 | N/A | Not Applicable | |||||||||||||||

| Note: | ||||||||||||||||||

| If your card products have different fees/charges, please indicate only the range, i.e. highest and lowest | ||||||||||||||||||

| Card Product/s | AUB Easy; AUB Classic; AUB Gold; & AUB Platinum | Classic, Gold, Platinum, World, Cash Installment Card | Your everyday spend is now more affordable with the new BPI Family Savings Credit Card. The no frills credit card that will help you and your family stretch your cash flow. With its low interest rate and membership fee, maintaining a credit card is now light on the pocket. |

Citi Simplicity+ | EastWest Priority Visa Infinite | Equicom Savings Bank Gold and Classic Credit Card | N/A | N/A | LANDBANK Classic LANDBANK Gold LANDBANK Corporate |

Maybank Classic/Standard, Maybank Gold,Maybank Platinum Credit Card and Maybank Visa Infinite Credit Card | "Vantage Card, Titanium MC, Rewards Plus Visa, World MC, Peso Platinum Visa, Femme Signature Visa, Travel Platinum Visa, Toyota MC, Femme Visa, ON Internet MC, PSBank Credit MC, M Free MC, M Lite MC" |

PNB Ze-Lo Mastercard | Regular Cards - MC Classic & Gold, JCB Classic & Gold, Visa Flex & Visa Flex Gold, & Co-Brand Cards Premium Cards - MC Platinum, MC World, MC Diamond, Visa Infinite, Visa Platinum, JCB Platinum, UnionPay Diamond |

n/a | n/a | |||

| Brief Description of Card Product/s | Waived ANNUAL Fees for Life!; Choose when to pay & how much to pay; | Earn as much as 5x Rewards points when you use your card at select dining and shopping establishments |

Special Installment Plan (S.I.P.) Loan : Balance Transfer Consolidate all your other credit card balances and pay in fixed monthly installments Special Installment Plan (S.I.P.) Loan : Balance Conversion Convert new staright regular and online purchases into a fixed monthly installment plan. Special Installment Plan (S.I.P.) Loan : Credit-to-Cash Convert your available credit limit to cash and pay in fixed monthly installments Special Installment Plan (S.I.P.) Loan : SIP for School Installment plan for tuition fees, school supplies, uniform to all other school needs Special Installment Plan (S.I.P.) Loan : SIP for Hospital Installment plan for all hospital expenses Real 0% Installment Shop at your favorite stores and enjoy installment payment plans at 0% rates. |

Citi Simplicity+ APR is 24% but has no annual fee, no late payment fee and no overlimit fee. In addition, customers who pay on time will get a 10% interest rebate. | a) Exclusive to EastWest Priority clients b) Low interest charge at 1.99% per month or 23.88% effective rate annually c) Annual Membeship Fee - Perpetually waived |

Visa-branded credit card products offered to bank depositors. Annual membership fee waiver for two (2) years. Offers unlimited supplementary cardholders. |

N/A | N/A | FEATURES Interest Rate - Lower Interest Rate at 2% per month. Wide Acceptability - LANDBANK Credit Card has global acceptance in over 30 million accredited merchants and convenient money access with 2.7 million ATMs across the globe Card Acceptance - LANDBANK Credit Card is accepted in all local and international participating /accredited merchants and member-banks of Mastercard Security - Enhanced card security features thru EMV Technology to safeguard customer and card information, and reduce card fraud in Card Present transaction Cash Advance - Up to 30% of credit limit through ATMs of Mastercard member banks Electronic Statement of Account (eSOA - sent to cardholder's nominated valid e-mail address. Cardholders who opt to receive a paper statement will be charged a statement printing/reprinting fee of Php100 monthly Purchase E-mail Alert - alerts sent to cardholders thru nominated valid e-mail address for every purchase made regardless of the amount 3D Secure One Time Password (OTP) - an added security feature for online purchases. This is sent to cardholder's registered mobile number and is used to authenticate the transaction 24 Hour Lost Card Hotline - Hotline service for lost/stolen cards: Call LANDBANK Customer Care Center (CCC) at (02) 8-405-7000 or PLDT Domestic Toll-Free Number 1-800-10-405-7000 Single Currency Billing - LANDBANK Credit Card features a Single Currency Billing where any foreign transaction will be billed in Peso Loyalty Program - cardholders earn one (1) Reward Point for every P30 spent online or via Point-Of-Sale (POS) terminals. Use points to pay for purchases, card annual fees and other charges (Click here for the sample conversion computation) Easy Pay Program - allows you to convert retail transactions, single purchases into monthly installments up to 24 months Easy Pay/ Equal Monthly Installment (EMI) - Add-on rate at 1% Wide Network of Payments Channels- accessible payment channels available to LANDBANK credit cardholders |

Regular Cards- Maybank Classic/Standard, Maybank Gold Premium/Lifestyle Cards- Maybank Platinum Credit Card and Maybank Visa Infinite Credit Card |

Regular Cards - Vantage Card, Titanium MC, Rewards Plus Visa, Toyota MC, Femme Visa, ON Internet MC, PSBank Credit MC, M Free MC, M Lite MC Premium Cards - World MC, Peso Platinum Visa, Femme Signature Visa, Travel Platinum Visa |

Zero Annual Fee, Low Interest Credit Card | n/a | n/a | ||||

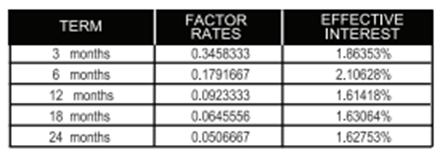

| Portfolio Action Product/s | (1) AUB Post Pay Installment Plans - convert straight charge purchases to installment payment terms; (2) AUB Balance Transfer Installment - transfer other card balances to the AUB card & convert to installment payment terms; (3) Cash Out Installment Plans - avail cash from the AUB credit card and convert to installment payment terms |

1. Balance Transfer -Low monthly interest rates (.49% at 36 mos) 2. GetCash - Get cash from your BankCom Credit Card and pay on installment up to 36 months 3. Convert to Installment - convert single or accumulated retail transactions to installment payments terms |

Special Installment Plan (S.I.P.) Loan : Balance Transfer - 0.99%-1.50% Add-on Rate Special Installment Plan (S.I.P.) Loan : Balance Conversion - 0.99% - 1.75% Add-on Rate Special Installment Plan (S.I.P.) Loan : Credit-to-Cash - 0.99% - 1.50% Add-on Rate Special Installment Plan (S.I.P.) Loan : SIP for School - 0.75% - 1.50% Add-on Rate Special Installment Plan (S.I.P.) Loan : SIP for Hospital - 0.75% - 1.00% Add-on Rate Real 0% Installment - 0% |

Below are Portfolio Action product which offer lower interest rates: a) Citi Balance Transfer b) Citi Speed Cash (Avail of cash on installment against credit card limit) c) Citi FlexiBill (Convert a portion of their Citi credit card’s Total Amount Due into installment) d) Citi Paylite After Purchase (Convert unbilled retail transactions into installment) e) Citi Paylite for Bank Transactions - (Convert any qualified and completed bank transaction (e.g. ATM cash withdrawal into installment) |

Installment loans a) Insta-Cash b) Balance Transfer c) Convert-to-Installment |

Equicom Amazing Zero Interest (EAZI 0%) Installment Deals, Equicom Super Check, Equicom Balance Transfer, Equicom Cash Deals, and Equicom Payment Deals |

N/A | Balance Transfer, Cash Installment Plan, Card Balance Conversion Plan |

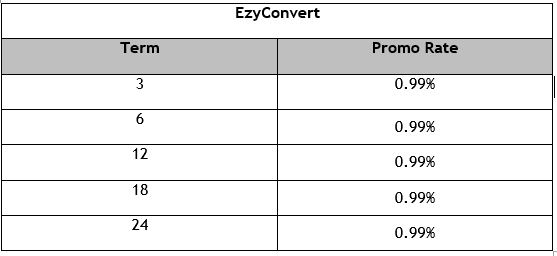

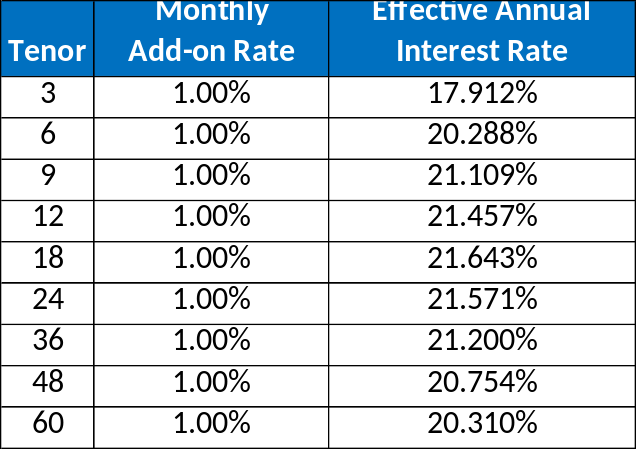

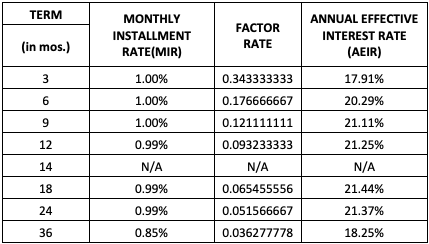

Easy Pay Program - allows you to convert retail transactions, single purchases into monthly installments up to 24 months | EzyConvert, EzyCash | Cash2Go, Balance Transfer, Balance Conversion |

n/a | Unli 0% Intallment, Unli Intallment, Balance Transfer, Cash Loan | n/a | n/a | balance transfer, charge for cash, retail conversion | ||

| Interest Rate/s | Installment Plans for 6&12 months at 1.00% monthly add-on rate | Installment rate of 1% | Zero Percent Installment for Disputed Transactions Special Balance Conversion Extended Payment Arrangement - Collection Fees and Discounts may apply. - Terms and Rates dependent on repayment amount and term. |

0.49% - 1% AOR | Up to 1% add-on interest rate per month. Special rates may be offered to select cardholders. |

1.0% monthly add-on for in-house installment programs | N/A | up to 1% add-on interest rate per month (May vary depending on cardholder performance) |

Easy Pay/ Equal Monthly Installment (EMI) - Add-on rate at 1% |

|

Cash2Go, Balance Transfer and Balance Conversion

|

1.88% | 2% | n/a | *1.00% AOR on all tenors *Special rates may be offered to select cardholders |

|

||

| Rewrite Programs | Zero Percent Installment for Disputed Transactions - 0% Special Balance Conversion - 1.5 - 2.5% Extended Payment Arrangement - 1-3% |

Below are Collections programs which offer lower interest rates: a) Rewrite Program b) IDRP Program |

Restructuring programs | Restructuring | N/A | Restructuring | None | Restructuring

|

N/A | n/a | Restructured Payment Scheme | 1. Restructuring Program (Regular Program) 2. Balance Conversion (Limited Offer Only for OVL, Xdays & 30 days Accounts) |

||||||

| Interest Rate/s | Product prices range from 0% to 18% APR | Restructuring Programs: Varies depending on internal policy, maximum 1% AOR in compliance to BSP |

BSP Circular No. 1098 compliance | N/A | Varies depending on internal policy | n/a | 0.99% to 2.5% per month | 1% AOR | n/a | 1.00% AOR | 1. For Restructuring : .75%-1.75% 2. For Balance Coversion - .75% - .99% |

|||||||