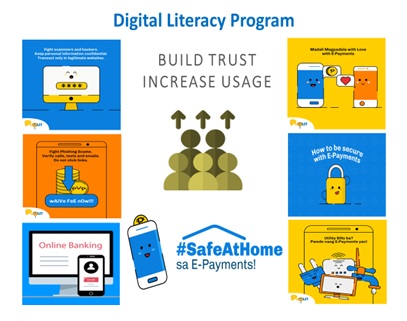

Digital Literacy Program

The BSP implements a Digital Literacy Program as part of our financial education advocacy. The Program aims to increase public trust and confidence in the digital finance ecosystem and encourage massive usage of digital financial services (DFS) by consumers across all sectors - individuals, corporations, businesses, and even government institutions. Through strategic communication campaigns, consumers are informed and educated to generate familiarity with DFS; reduce their vulnerability to usage errors, scams and frauds; mitigate risk of loss; protect consumer welfare; and ensure positive customer experiences and outcomes.

A component of this Program is the #Safe at Home with E-Payments Campaign to promote usage of e-payment solutions such as PESONet and InstaPay during the COVID-19 pandemic and beyond. Communication materials are developed and delivered through social and traditional media, and shared with fintech and banking industry associations for utilization in their own information drives. Another component of the Program is a Cybersecurity Awareness Campaign to ensure that financial consumers remain vigilant in practicing appropriate cyber hygiene to protect their accounts and online transactions. These Campaigns are implemented with support from the United States Agency for International Development, particularly the E-PESO Project. A unified set of digital literacy and cyber security messages, when amplified together with key stakeholders, increases recall and resonates more widely among Filipinos, bringing us closer to our shared goal of a cash-lite society.