Starting April 7, automated teller machines (ATMs) will adopt the “acquirer-based ATM fee charging” (ABFC) model.

What is ABFC?

It is a market-based pricing model that lets the ATM-owner—who invests in the machines and infrastructure to service cardholders—set the fees for transactions. Currently, ATM owners (usually banks) are only given a fixed share in fees collected.

Under the ABFC, usage of ATMs of a cardholder’s own bank shall remain free of charge. However, using ATMs of different banks shall incur fees that would vary depending on the owners’ business model, deployment strategy, pricing scheme, etc. Cardholders will be empowered to choose an ATM terminal that charges the lowest fees and provides more reliable service.

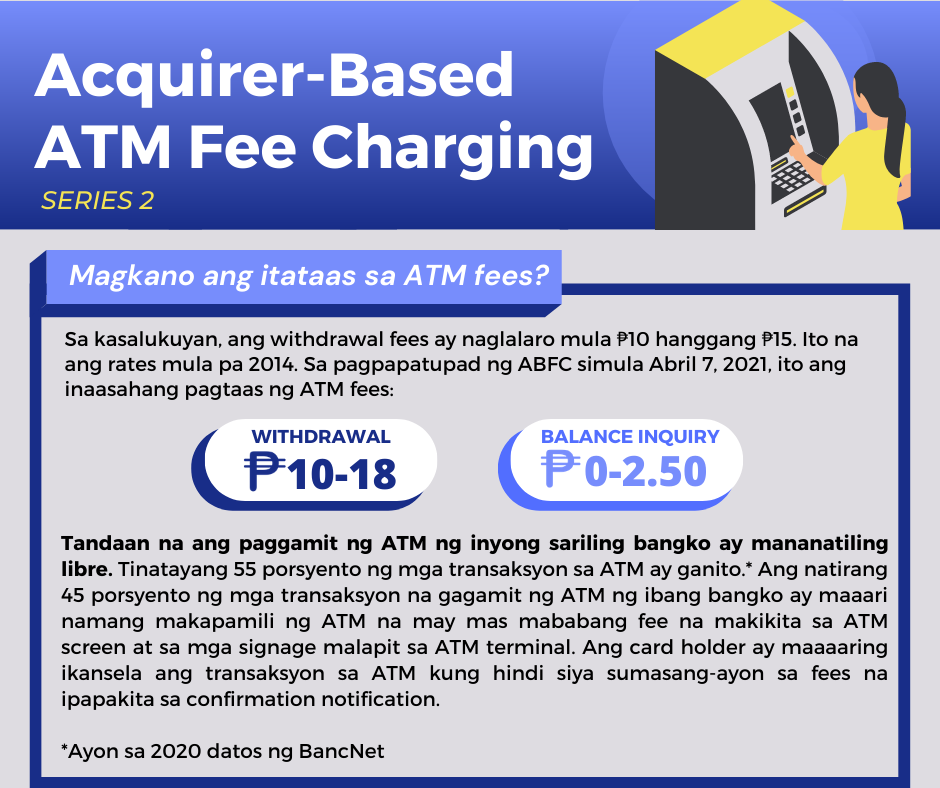

How much will the increase be in ATM fees? Currently, ATM withdrawal fees range from P10 to P15 which have been the rates for the past seven years. When the ABFC is adopted starting April 7, here are the expected rates:

-

withdrawal: P10 - P18

-

balance inquiry: P0 - P2.50

Keep in mind that transactions in ATMs of a cardholder's own bank are free of charge. In fact, 55 percent of all ATM transactions are made with one's own bank.* The remaining 45 percent of transactions of those who need to use ATMs of different banks may choose the ones with the lowest charges. Fees will be displayed on the ATM screen and on signages in the area. An ATM user may cancel the transaction if he/she does not agree with the fee to be charged.

*Based on 2020 BancNet data

Why adopt the ABFC model?

Imposing fees will be simpler and transparent

Transaction fees shall be displayed on the ATM screen and on signages near ATM terminals so that cardholders may be free to choose which ATM offers the lowest charges. Cardholders may cancel the transaction if he/she does not agree with the charge stated in the confirmation notification.

ATM owners will be reasonably compensated for costs incurred

The current imposition of a fixed share in fees collected is considered unreasonable and is believed to be the reason for the decline in the growth of ATMs since 2013. The ABFC aims to incentivize ATM owners (usually banks) to put up more terminals even in rural and remote areas.

Competition would benefit consumers in the long run

Banks competing with one another to attract non-clients to use their ATMs by disclosing fees and providing more reliable service would make the Philippine ATM system expand and be more efficient ultimately, benefit consumers.

Ways to avoid paying ATM fees

Use the ATM of your own bank

Under the ABFC, transactions in ATM terminals of the cardholder’s own bank shall remain free of charge.

Go digital! Use alternative payment solutions such debit/prepaid cards, QR codes, or fund transfers via PESONet and Instapay. These are quick, safe, and convenient payment options available to consumers anytime, anywhere.

|