Payments and Settlements

Published Date:

Published By:

Page Content

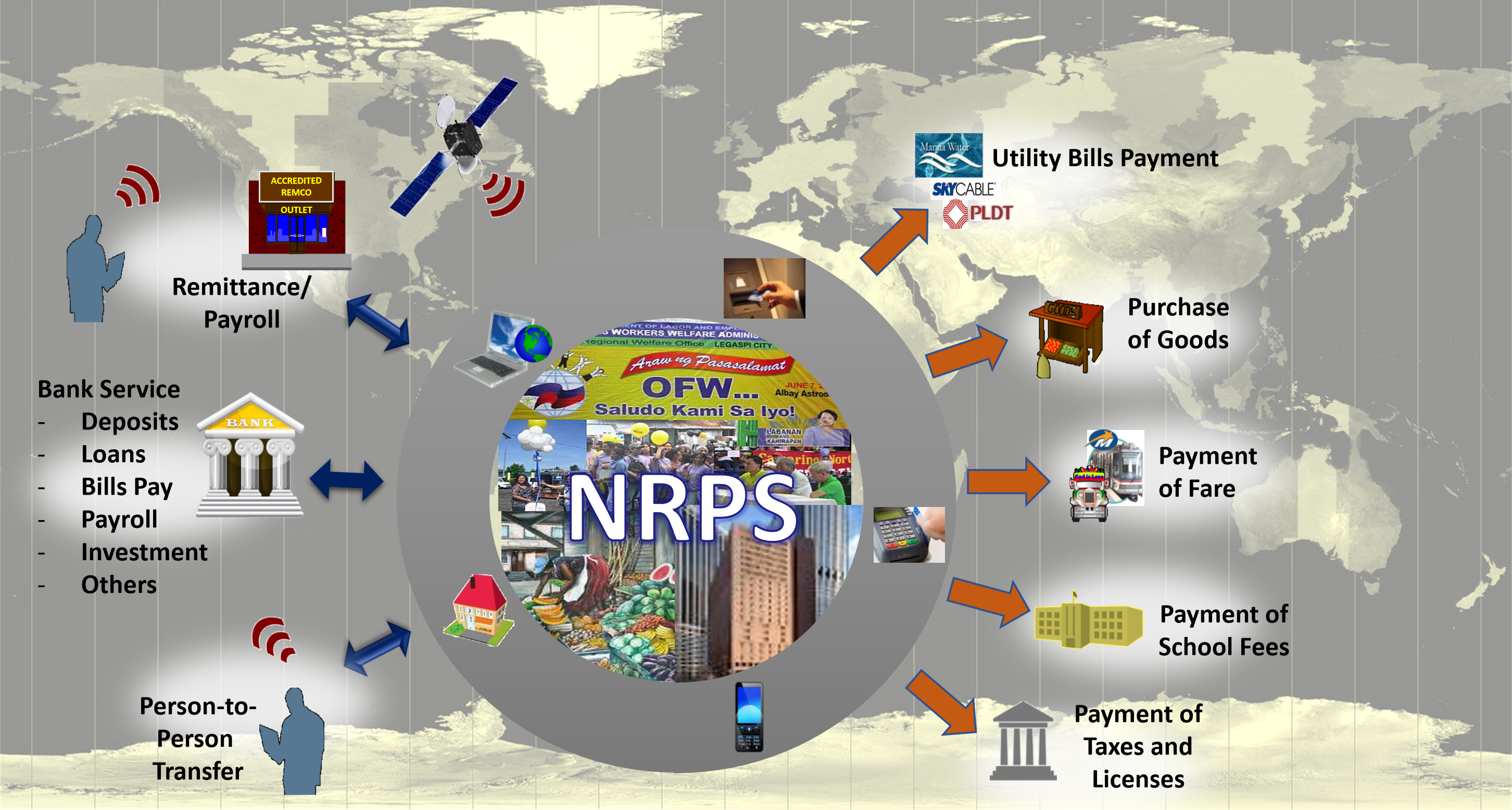

National Retail Payment System

The National Retail Payment System or NRPS is a policy and regulatory framework that aims to provide policy direction in carrying out retail payment activities through BSP supervised financial institutions (BSFIs) by defining high-level policies, principles, and standards, which when adopted, would lead to the establishment of a safe, efficient and reliable retail payment system.

Observance of the principles and standards result to safety by ensuring the security of transactions and activities performed in the country’s retail payment system, and reliability by ensuring resiliency of operations against disruptive events. Efficiency in retail payments is essentially about speed, convenience and affordability, which can be brought about by effective interoperability among payment service providers and clearly be supported by the strategic shift to electronic payments. Thus, a key outcome of the NRPS is to increase adoption of electronic retail payments from 1% electronic payments in 2013 to 20% electronic payments by 2020.

The Regulatory Framework

lt is the policy of the Bangko Sentral to promote the establishment of a safe, efficient, and reliable retail payment system in the Philippines. Towards this end, the Bangko Sentral adopts the National Retail Payment System (NRPS) Framework consistent with Bangko Sentral regulations on risk management in light of the complex interplay of different types of risk arising from the rapid evolution of retail payment activities of Bangko Sentral supervised financial institutions (BSF|s). The NRPS vision will help achieve higher economic growth and enhance the overall competitiveness of our economy. For a detailed discussion on the framework,

click here.

Empowering Every Juan and Maria

The NRPS envisions every Juan and Maria to have easy access to financial services, have accounts to make payments, receive or transfer funds to other accounts anytime, anywhere, at a reasonable price, from any digital device. To learn more on how NRPS can benefit Filipinos,

click here.

Fees on Electronic Payments

To enhance transparency and competitiveness among banks and electronic money issuers (EMIs) that provide electronic payments to their customers, BSFIs are required to submit to the BSP (in accordance with BSP Circular 980) the details of all fees that will be charged to their clients when performing electronic payments. To help you decide the best value for your money in doing electronic payments,

click here.

ACH Participants

Frequently Asked Questions

Created:6/17/2020 3:21 PM by:

Pambid Frederick D.

Modified:8/27/2021 3:06 PM by:

Pambid Frederick D.