Institutional Arrangements

Effectively managing systemic risks is a shared undertaking across many different stakeholders. As such, the objective of

Financial Stability warrants an institutional arrangement to ensure continuous focus while setting clear accountabilities.

Local

- Financial Stability Policy Committee of the BSP

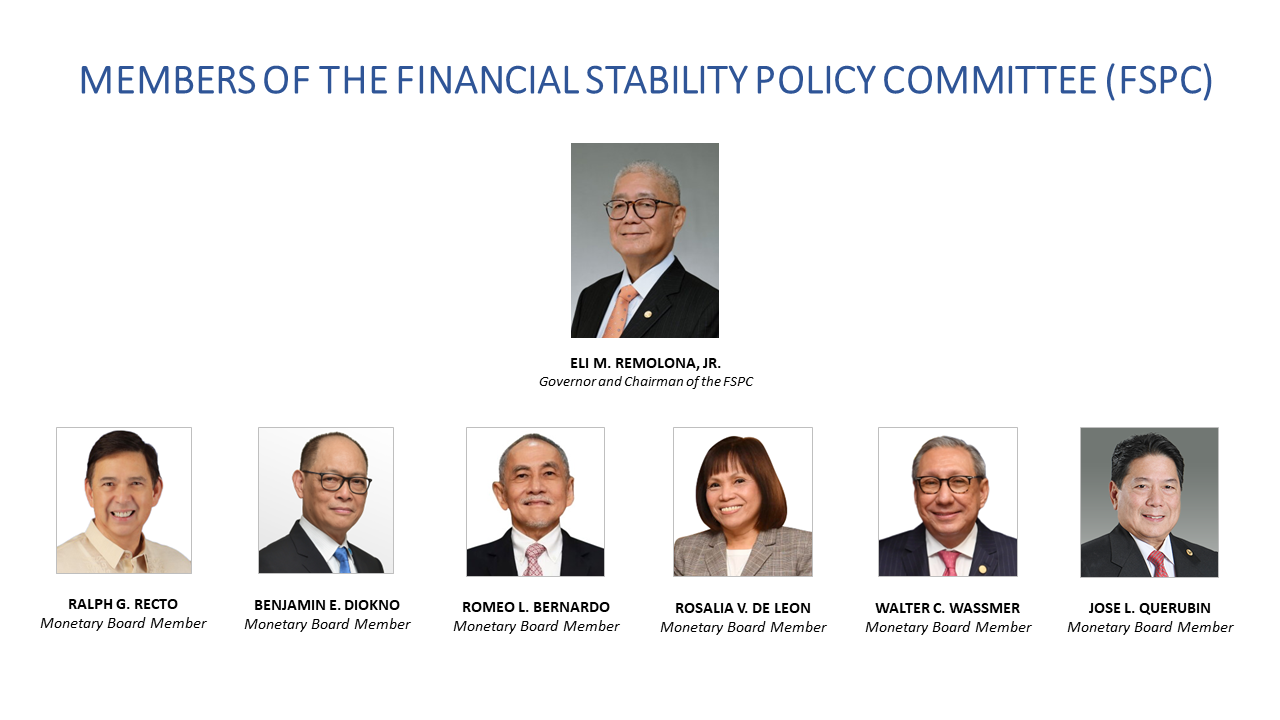

The Monetary Board approved the creation of the FSPC to oversee and decide on the financial stability initiatives of the BSP. The FSPC was officially convened on 26 February 2020 by the BSP Governor as its Chairman, counting on the other Monetary Board Members (MBMs) as FSPC members. The FSPC meets six times a year.

- Financial Stability Coordination Council

The FSCC is an inter-agency council where the principals from the BSP, the Department of Finance, the Securities and Exchange Commission, the Insurance Commission, and the Philippine Deposit Insurance Corporation convene quarterly. These meetings provide the venue to assess possible systemic risks and to decide appropriate macroprudential policy interventions. The National Treasurer is likewise an active participant in the discussions of the FSCC and is a Special Member of the Executive Committee. The FSCC, which was convened on 4 October 2011 and then formalized on 29 January 2014 through the signing of a Memorandum of Agreement, is chaired by the BSP Governor.

- Office of Systemic Risk Management

In January 2017, the BSP created OSRM as the designated financial stability unit of the BSP. Due to the uniqueness of its policy focus, OSRM reports directly to the BSP Governor. It also serves as the Technical and Administrative Secretariat of both the FSPC and the FSCC, while supporting the Governor in the Regional Consultative Group for Asia of the Financial Stability Board (FSB-RCGA). OSRM is led by BSP Assistant Governor Veronica B. Bayangos, PhD.

Regional

- FSB-RCGA

BSP Governor Eli M. Remolona, Jr. is a member of the FSB Regional Consultative Group for Asia. The FSB is an international institution that recommends risk and prudential standards for the financial markets.

- FS Network

Launched on 21 January 2019, the FS Network is a venue to raise awareness on financial stability issues and a means for facilitating an active exchange of knowledge, insights, information, and experiences among members in their respective pursuit of financial stability.

Communication and queries are often coursed through OSRM which serves as the central point of contact for the network. Alternatively, OSRM provides the means to bilaterally connect members. Parties may send an e-mail to

FSNetwork@bsp.gov.ph.