OPEN FINANCE PH

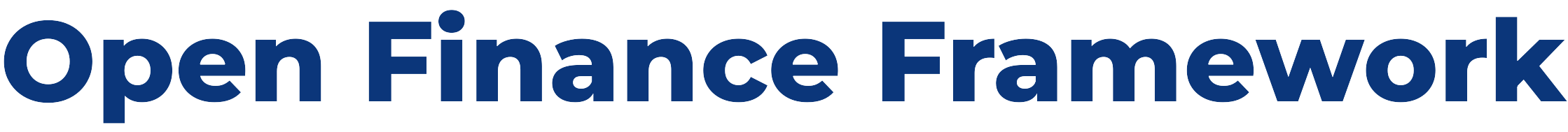

The Bangko Sentral aims to empower customers

by giving them better control over their personal and financial data

catalyzing the development of products and services that are responsive to their needs.

Open Finance PH

Pilot

Other Links

Open Finance refers to

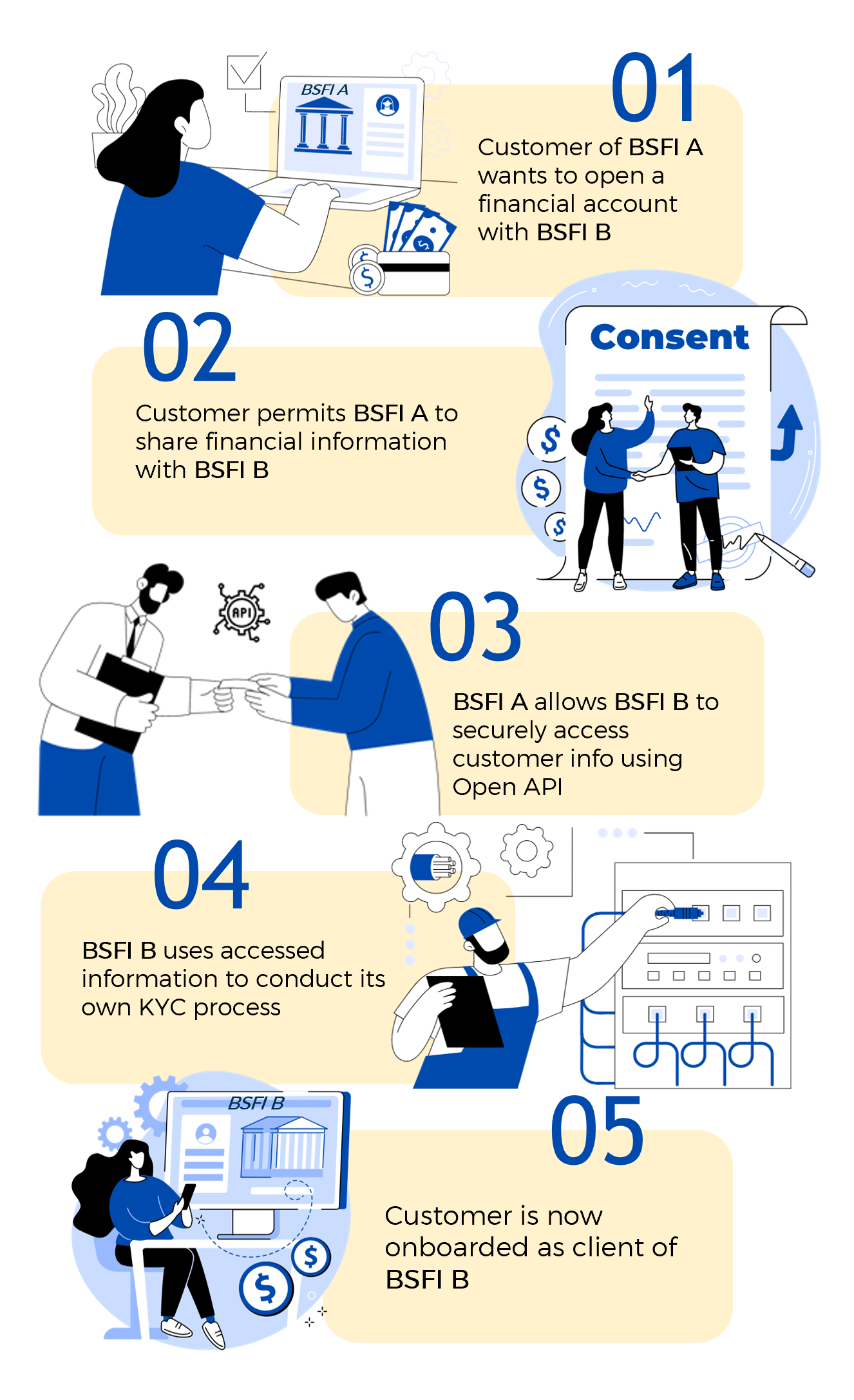

leveraging on and sharing of customer-permissioned data among banks, other financial institutions, and third-party providers to develop innovative financial solutions, such as among others, those that provide real-time payments, promote greater transparency to accountholders, and provide marketing and cross-selling opportunities to banks, other financial institutions, and TPPs.

PURPORTED BENEFITS

For the Filipino people

-

Allowing ownership and portability over their personal and financial data, giving them more control to access and securely share their data

-

Generating awareness, knowledge, and actual experience of using new fintech products and services

-

Enabling access to value-added services to help with day-to-day financial management, including budgeting, reconciliation, access to competitive credit products, streamlined identity management, and more

For BSFIs and market players

-

Exploring new revenue and growth opportunities through product development and partnership with other market players and service providers within and beyond BSFI-owned channels

-

Assessing the demand for new financial services offered to customers, including obtaining feedback

-

Rethinking how to apply technology and use data in meaningful ways to improve the economy’s future-readiness by aligning digital transformation and sustainability objectives

promotes consent-driven data portability, interoperability, and collaborative partnerships among entities who adhere to the same standards of data security and privacy.

Consumers will have the power to grant access to their financial data that will shape a customer-centric product development objective. The framework

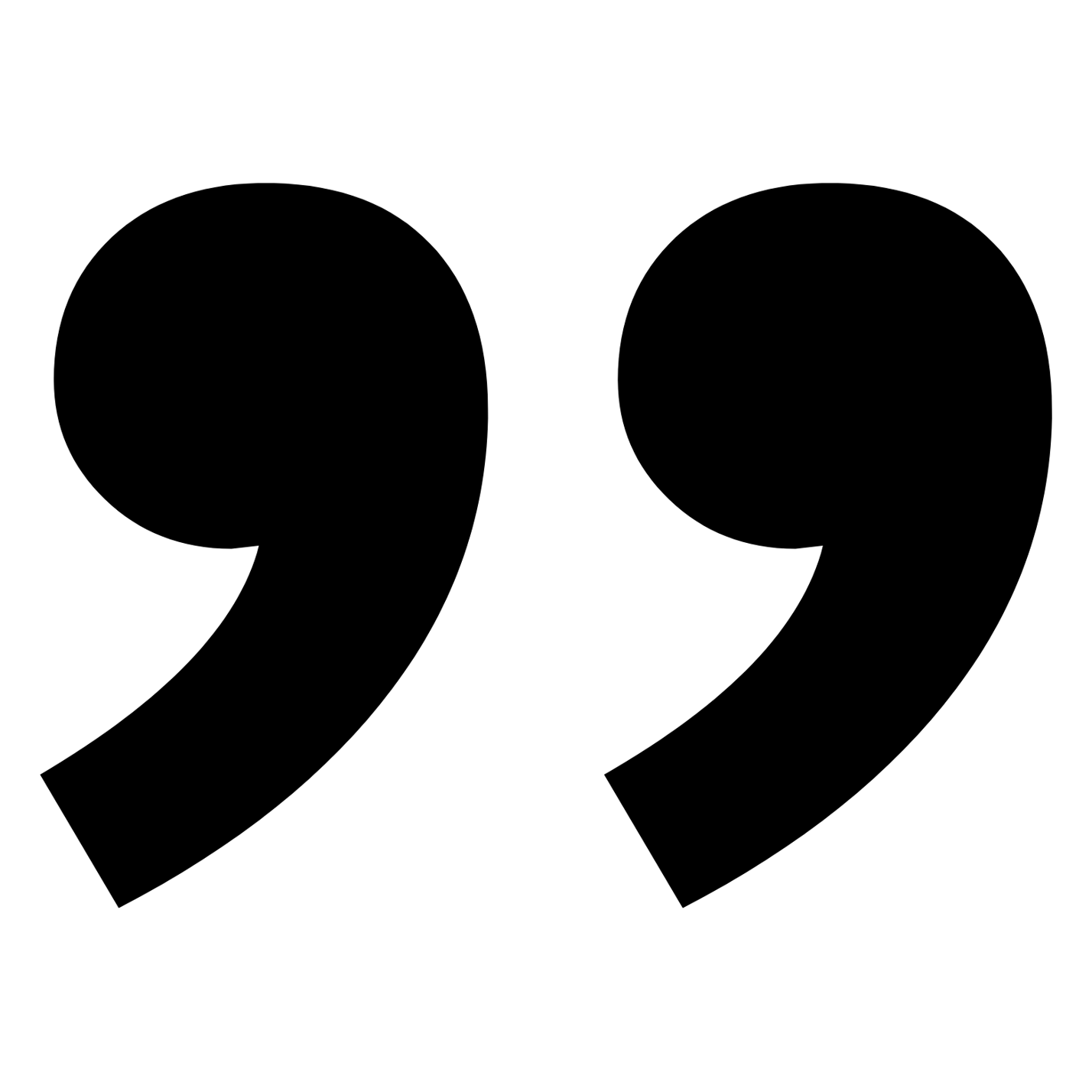

covers different financial institutions and a broader array of financial products such as, but not limited to, banking products and services, investments, pensions, and insurance.

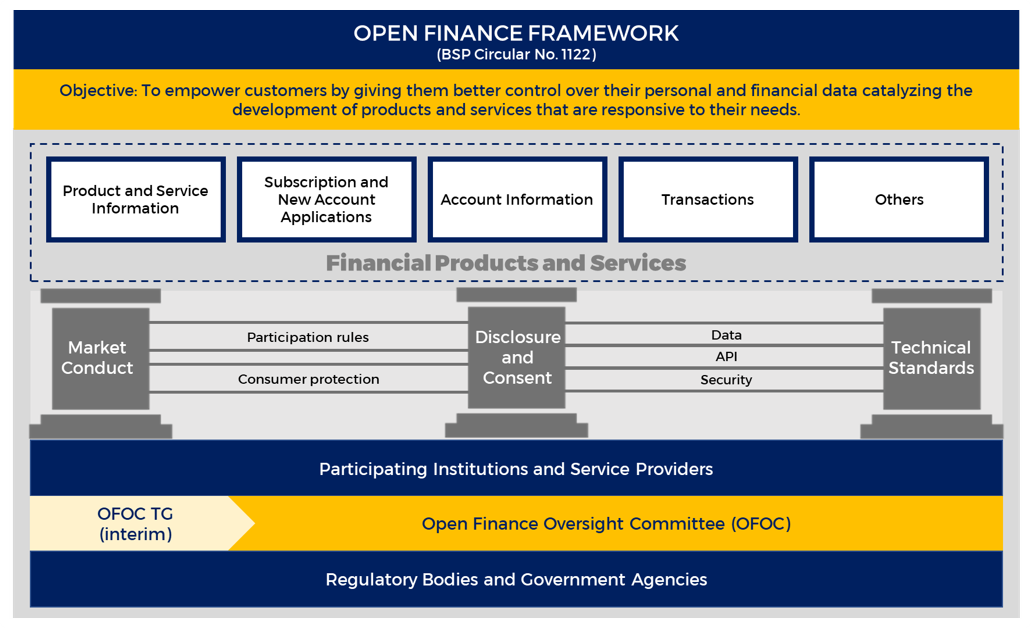

Open Finance is based on the right to personal data portability. With customers’ authorization, financial institutions (FIs) provide authorized third-party providers (TPPs) permissioned access to their customers’ banking and financial data to initiate payments or to offer additional services using those information.

The reason we need a framework is to protect the information of the customer. The privacy of the customers has to be protected so that the data on the customer can only be used with the permission of the customer. [T]hat’s the whole point of why the BSP is part of this. Banks can do this on their own, but the BSP wants to be part of it just to ensure that the customer is protected. That’s the open finance framework.

The reason we need a framework is to protect the information of the customer. The privacy of the customers has to be protected so that the data on the customer can only be used with the permission of the customer. [T]hat’s the whole point of why the BSP is part of this. Banks can do this on their own, but the BSP wants to be part of it just to ensure that the customer is protected. That’s the open finance framework.

BSP Governor Eli M. Remolona, Jr.

6 March 2024 Good Mornings with Gov Eli

Open finance would further evolve to an open data economy, through multi-agency collaboration and involvement, which considers how consumer data may be used to develop solutions, products, and services that cut across industries and is increasingly being recognized as resource with high economic and social value and as an effective approach for smarter data governance.

Alignment with national initiatives

Proposed e-Governance Act

Proposed e-Governance Act

National Strategy for Financial Inclusion

National Strategy for Financial Inclusion

Philippine Development Plan 2023-2028

Philippine Development Plan 2023-2028

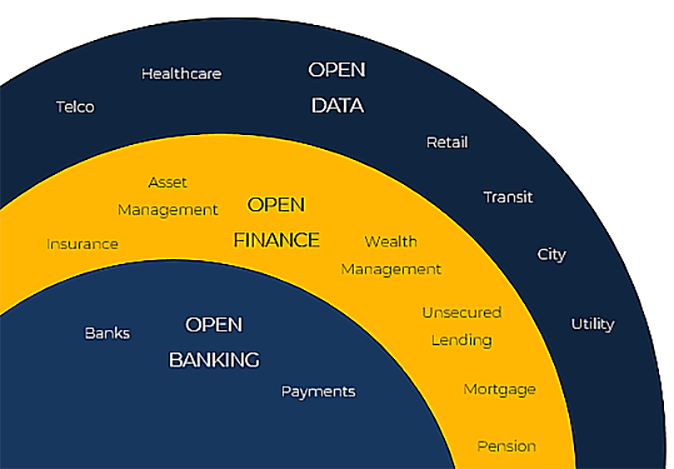

The Roadmap is anchored on the BSP’s digitalization and sustainability agenda and would serve as a key driver in future-proofing the financial services industry to support the Philippine Government in strengthening financial sector stability, integrity, and resilience, expanding financial inclusion, and catalyzing sustainable finance.

This roadmap covers activities that seek to enhance capacities and raise environmental, social and governance (ESG) standards in the banking sector, ultimately contributing to the achievement of the 2030 agenda for sustainable development.

It outlines priority actions that would require three key components:

CAPACITY BUILDING

aimed at creating a fit-for-purpose entity with the capacity for an open finance ecosystem

COLLABORATIVE ENGAGEMENTS

towards the establishment of functional working groups for standards development

COMMENSURATE REGULATIONS

to facilitate the implementation and expansion of open API services for market adoption

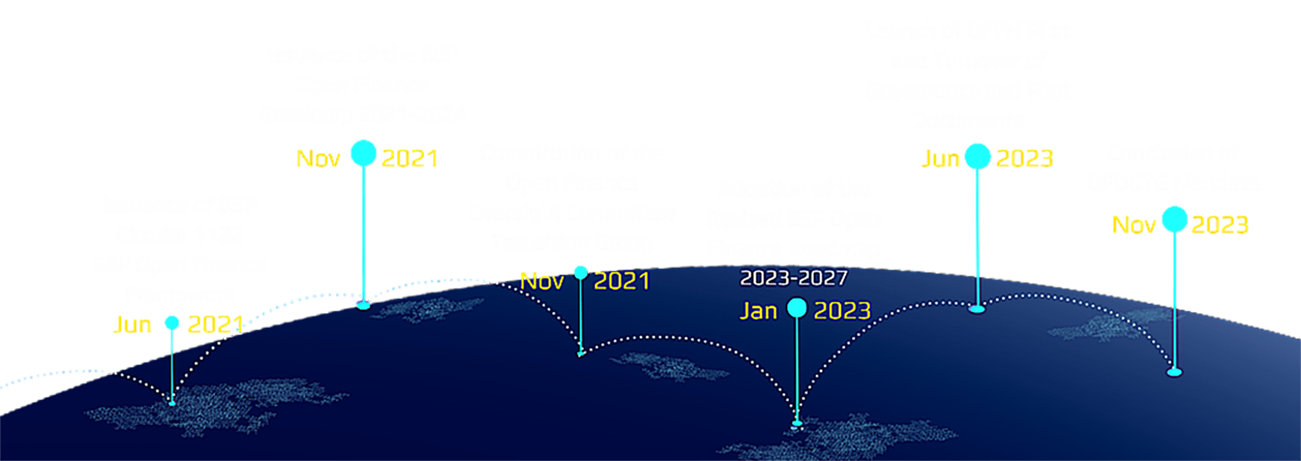

Pilot preparations

Constitution of the Open Finance Advisory Board

Coordination with BSFIs

Coordination with Financial Sector Forum

Establishment of registration process for third party providers

Exploring SupTech solutions

The Philippine Open Finance Pilot (“Open Finance PH Pilot") is a collaborative undertaking of financial institutions, participating on a voluntary basis, to explore the use of Application Programming Interface (API) technologies in the delivery of financial products and services responsive to the needs of customers.