Overview

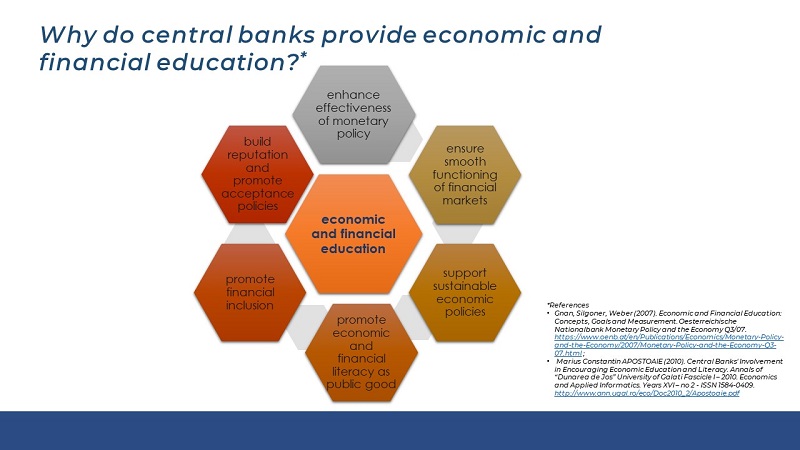

The BSP, through the Economic and Financial Learning Office (EFLO) continues to promote awareness of key economic and financial concepts and issues, and a better understanding of the role of BSP in the economy. The EFLO's work program and strategies are anchored on the principle that a well-informed public, literate in basic economic and financial concepts could make informed decisions leading to better saving, asset-building, use of credit, and, ultimately, economic and financial well-being. Moreover, the EFLO's initiatives help strengthen the public's trust in BSP's policies and promote long-term price stability through well-anchored inflation expectations. The theory of change shown below reflects the desired outcome of EFLO's major activities, which includes:

- regular conduct of the Economic and Financial Learning Program (EFLP) activities;

- deepening of the Financial Education (FinEd) Partnerships; and

- continuing implementation of the Knowledge Resource Network (KRN) initiative.

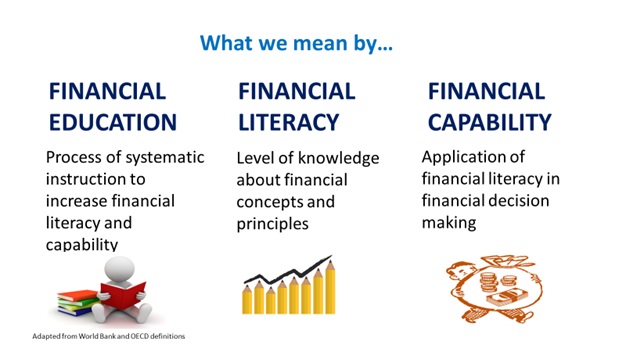

Financial education, the systematic process of acquiring financial literacy, enables people to better manage their financial lives and optimize the benefits of accessing financial services. It becomes more important as we onboard people who are less informed and less able to make sound financial decisions. Financial education thus forms part of the BSP’s broader objective of building an inclusive financial system. Through financial education, we hope to raise generations of financially literate Filipinos confident to use a range of financial services; and capable of making prudent financial plans, building reserves, accumulating assets, managing debt, and exercising their rights and responsibilities as financial consumers. Our aim is to establish a financially healthy and economically empowered Filipino citizenry contributing productively to the Philippine economy.

Related Links: